september child tax credit payment short

The Rescue Act made the full Child Tax Credit available to children in families with low earnings or that lack earnings in a. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

The next Advanced Child Tax payment is due to go out on October 15th.

. Families can receive 50 of their child tax credit via monthly payments between. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

The first half of the credit is being delivered in monthly direct deposits from July through December of 300 for children under 6 and 250 for those aged 6 to 17. Eligible families who do not opt-out will receive 300 monthly for each child under 6. Each qualifying household is eligible to get.

Child Tax Credit Available Share with Families. The third of the six advance monthly Child Tax Credit payments will hit bank accounts 15 September. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Whether or not another IRS glitch is. Last week the IRS. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid.

Millions of families across the US will be receiving their third advance child tax credit. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax. Parents still have time to submit their taxes and make all of their qualifying benefit claims including a 750 direct payment in Child Tax Credit even though tax season is over.

Subsequent stimulus checks will be sent to households on October 15 November 15 and December 15. WJW While some parents didnt receive the September child tax credit payment because of a glitch in the system last month others did get a payment in their hands but it was. Eligible families who do not opt-out will receive 300 monthly for each child under 6.

The payments were authorized through President Bidens American. We dont make judgments or prescribe specific policies. Everything is included Premium features IRS e-file 1099-MISC and more.

That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August Child Tax Credit money. How the Child Tax Credit Expansion Helped Families. The installment which had already been under.

15 and while most households have received their payments not all households have been so lucky. There are reports however the September payment was short or did not come at all. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children over the age of 6 and it rose to 3600 from 2000 for children under the age. AMERICAN families have complained that they have been shorted money in their September child tax credit payment. The last child tax credit check was issued on Sept.

As a result the IRS released a statement last week about the issue. About 35 million American families will get child tax credit payments this month the federal government announced on Wednesday as the third batch of advance monthly. The ARP increased the 2021 child tax credit from a maximum of 2000 per child up to 3600.

The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17. Eligible families who do not opt-out will receive 300 monthly for each child under 6. The next child tax credit payments will start arriving on September 15.

As part of The American Rescue Plan nearly every family can get the expanded Child Tax Credit. See what makes us different.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Reforming The Earned Income Tax Credit And Additional Child Tax Credit To End Waste Fraud And Abuse And Strengthen Marriage The Heritage Foundation

The Politics Of The Child Tax Credit The American Prospect

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Millions Of Eligible Families Did Not Receive Monthly Child Tax Credits While More Than 1 Million Ineligible Taxpayers Did Cnn Politics

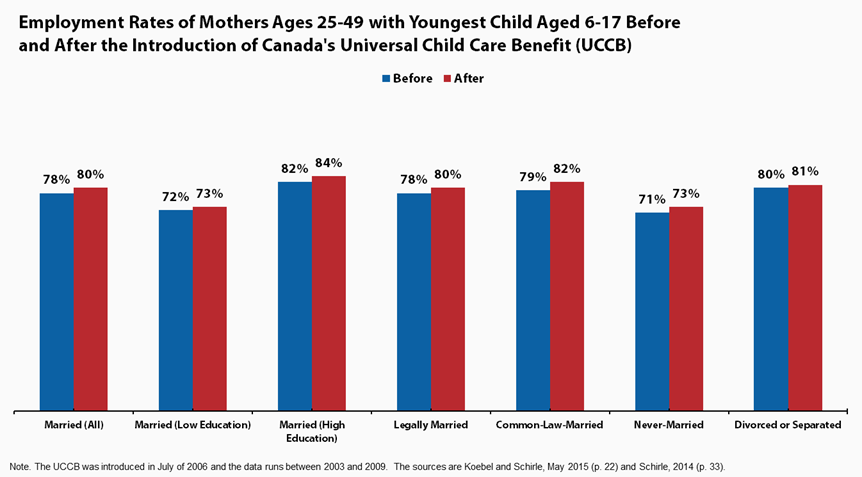

New Research Finds The Child Tax Credit Promotes Work Niskanen Center

Biden S Child Tax Credit Is Withdrawn Causing Anger And Concern

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Low Income Housing Tax Credit Ihda

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities